Get Your Free 1st Issue

Your Homes Overseas Magazine!

Discover the best destinations, property tips, and lifestyle insights from around the world.

GET YOUR FREE MAGAZINE HERE!

Discover the best destinations, property tips, and lifestyle insights from around the world.

GET YOUR FREE MAGAZINE HERE!

When buying property overseas, most people focus on location, lifestyle, and investment value. But one of the most critical (and often forgotten) questions is:

👉 “What happens to my healthcare if I move abroad?”

👉 “Does Medicare cover me overseas?”

The truth is that healthcare access varies widely depending on your destination. If you’re retiring abroad, working remotely, or buying an investment property, you’ll need to understand how Medicare, private health insurance, and local healthcare systems work before making the move. Planning your international property purchase with these factors in mind ensures a safer and more comfortable transition.

This guide explains everything you need to know — with a focus on US retirees (Medicare), UK pensioners (NHS & S1), and international visa requirements.

Original Medicare (Parts A & B) generally does not cover medical services outside the US.

Very limited exceptions apply, such as:

Medicare Part D (prescriptions) and Medicare Advantage (Part C) usually do not cover care abroad either.

Bottom line: If you’re moving overseas, you’ll need separate healthcare insurance in addition to keeping Medicare active.

Yes — many US retirees continue paying Medicare premiums while living abroad. Why?

However, Medicare will not reimburse you for care abroad. This means you’ll need:

Inside the EU, Switzerland & Treaty Countries:

Outside the EU:

Returning to the UK:

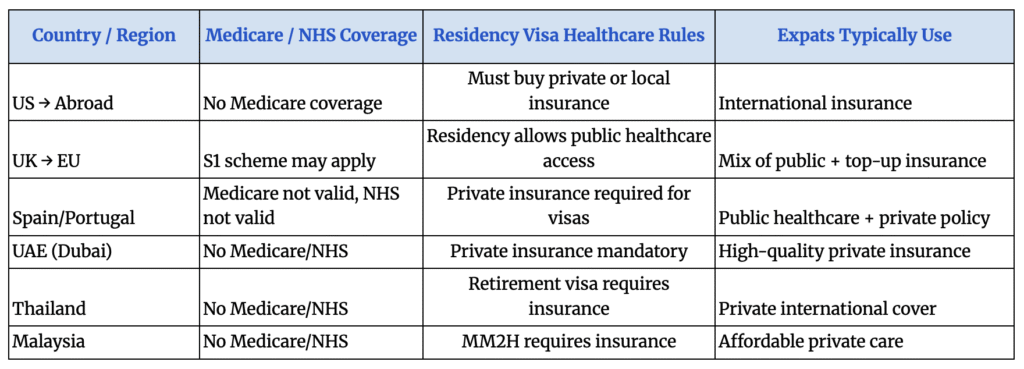

When buying property abroad and planning to live overseas, you need to understand how the local healthcare system works to ensure proper coverage and peace of mind.

Residency visas often require proof of health insurance. Examples:

Spain, Portugal, Greece: Must show private health insurance to secure non-lucrative, retirement, or Golden Visas.

Thailand Retirement Visa: Requires proof of insurance with coverage for at least THB 400,000 inpatient care.

UAE Golden Visa: Health insurance proof is mandatory before approval.

Malaysia MM2H: Medical insurance is compulsory for participants.

If you’re retiring or living abroad, you’ll typically choose from:

Europe: Spain and Portugal offer affordable healthcare compared to the US. Insurance premiums vary but can be €1,500–€3,000 per year for retirees. Both are among the best countries to live in for those seeking quality healthcare and a relaxed Mediterranean lifestyle.

Asia: Thailand and Malaysia have lower costs, but insurance becomes more expensive with age.

UAE/Dubai: Healthcare is world-class but costly — private insurance is a must.

Latin America: Mexico and Costa Rica offer low-cost but good-quality care, often popular with US retirees.

Tip: Factor healthcare into your retirement cost of living calculations when budgeting for property abroad.

❌ Assuming Medicare or NHS will cover you abroad — they won’t.

❌ Forgetting healthcare proof is required for many residency visas.

❌ Ignoring age-related premium increases for private insurance.

❌ Underestimating currency exchange risks (insurance premiums often priced in USD/EUR).

❌ Not checking if pre-existing conditions are covered in your new policy.

Q: Can I use Medicare in Europe?

No. Medicare does not cover you in Europe (or elsewhere outside the US).

Q: Can UK pensioners use NHS abroad?

No. The NHS is for UK residents only. However, in the EU you may be covered under the S1 scheme.

Q: Do I need health insurance for a Golden Visa?

Yes. Most Golden Visa and residency programmes require private health insurance before approval.

Q: What’s the best option for expats?

Most retirees abroad use a combination: local healthcare + private insurance for major emergencies.

Healthcare planning is just as important as choosing the right property. Medicare does not cover you abroad and the NHS has strict limits, so expats and retirees must rely on private or local health insurance. Many countries even make insurance a legal requirement before granting residency.

At International Property Alerts, we help you look beyond the property itself. We make sure you understand how healthcare, visas, pensions, and costs of living fit together — so your move abroad is safe, secure, and stress-free. For expert guidance and personalized support, contact us today.

📧 elly@internationalpropertyalerts.com

🌐 www.internationalpropertyalerts.com

📱 WhatsApp: +44 7796 174253

About International Property Alerts

International Property Alerts is a premier global platform connecting real estate investors with handpicked opportunities in emerging and lifestyle-driven markets. Through curated listings, expert guidance, and market insights, we help buyers make confident property decisions worldwide.

Media Contact:

Phone: +4420 3627 0106

📱 WhatsApp: +63927 073 9530

Email: office@internationalpropertyalerts.com

Elle Resort & Beach Club offers a rare chance to own property in one of the most desirable coastal locations. With limited units, strong capital growth potential, and unmatched resort facilities, this is your opportunity to secure a beachfront lifestyle with long-term value.

Thinking about buying property abroad? Don’t make the move without the right knowledge. Our Free Buyers Guide gives you essential insights on legal steps, taxes, financing, and the best markets worldwide. Trusted by international buyers and investors.

Wake up to bright, spacious living with stunning views and modern comforts. Whether for family living, retirement, or a stylish retreat, Sudara Residences makes your dream home a reality

Discover curated property listings with IPS—residential, commercial, villas, land—and get expert guidance through every step.

BONUS: FREE Cambodia Buyer’s Guide

High visibility. Targeted audience. Maximum exposure. Rent this space and let your brand shine.

Get your properties in front of high-intent investors. Showcase your listings to buyers worldwide.

From pounds to pesos, yen to dollars. ⚡ Quick. Easy. Secure.

Compare listings

ComparePlease enter your username or email address. You will receive a link to create a new password via email.