Get Your Free 1st Issue

Your Homes Overseas Magazine!

Discover the best destinations, property tips, and lifestyle insights from around the world.

GET YOUR FREE MAGAZINE HERE!

Discover the best destinations, property tips, and lifestyle insights from around the world.

GET YOUR FREE MAGAZINE HERE!

Planning for retirement in the UK is an important step for anyone thinking about their future. It means deciding how you want to live when you stop working. Retirement is not just about age, it is also about comfort, security, and peace of mind. In the UK, many people look at their income, housing, and lifestyle before making choices about retirement. This includes knowing the official retirement age, understanding living costs, and exploring the options that help make retirement more enjoyable and stress-free.

At International Property Alerts, we guide people who want clear answers about retirement and property choices. Many retirees want simple, reliable information that helps them prepare without confusion. We explain rules in plain language and share useful details about pensions, housing, and investments. Our goal is to make sure anyone who wants to retire in the UK feels confident and ready to take the next step in planning their future.

Retirement in the UK means stopping full-time work and beginning a new stage of life with more freedom, rest, and time for the things you enjoy. For people living in the UK and those moving here, it often includes receiving a pension, having access to healthcare, and enjoying a slower pace of life. In other words, retirement in the UK is about planning your days the way you want whether that means traveling, spending time with family, or just relaxing.

Above all, it’s about making smart choices early. Many people want to know what the retirement age in the UK, so they can prepare. Right now, the retirement age depends on your birth year and can change in the future. That’s why it’s helpful to plan early, especially if you’re thinking of staying in the country long-term or buying property in United Kingdom as part of your retirement plan.

People choose retirement in the UK for many reasons. It’s a place known for safety, good healthcare, and a high quality of life. Also, you’ll find friendly communities and beautiful places to live. Here are just a few benefits:

In addition, the UK is a great place to stay active. There are walking paths, fitness groups, and social clubs just for retirees.

The retirement age in the UK is the age when people can begin to collect their state pension. Right now, most people can retire at 66 years old. But this age can change depending on your birth year and government rules. In other words, not everyone will retire at the same time.

So, it’s important to plan ahead and know what applies to you. Men and women now share the same retirement age, which wasn’t always the case. In the past, women could retire earlier than men. But today, the law is the same for both.

The government reviews the retirement age in the UK every few years. After that, they may raise it to help keep the pension system strong. This means younger people might retire later than those already close to retirement.

For instance, there are plans to raise the retirement age to 67 by 2028 and possibly 68 in the future. These changes happen slowly, so people have time to prepare.

If you’re planning for retirement in the UK, knowing your retirement age helps you make smarter choices about work, savings, and lifestyle. You can check your pension age online or through the government’s official service.

In addition, understanding these rules can help you decide when to retire and how much you’ll need. This is especially helpful for those moving to the UK later in life.

Above all, staying informed helps you avoid surprises. You can learn more about retirement plans and legal changes in our country guides section.

When planning for retirement in the UK, your lifestyle and living choices matter a lot. You’ll want to think about where to live, how much things cost, and what your daily routine might be like. In other words, it’s about enjoying this new stage of life with peace, comfort, and smart choices.

Some people retire in cities, where everything is nearby—hospitals, shops, and fun places. So, it’s easy to get around and stay social, but the cost of living can be higher.

Others move to small towns or countryside areas. These places are more peaceful, and costs are often lower. After that, you might need to travel a bit more for services like doctors or groceries.

There are many ways to live during retirement in the UK. You can rent, buy, or join a retirement village. Some people sell their big home and move to a smaller one, which helps them save money and enjoy life more.

For instance, if you want to grow your savings while enjoying your home, look into the best retirement investment options in the UK. Buying a property can be a safe and smart way to use your money.

Life doesn’t slow down unless you want it to. There are clubs, walking groups, libraries, and hobby classes for retirees. So, you’ll have plenty of chances to meet people and stay active.

Healthcare is a big reason many people choose retirement in the UK. You can use the National Health Service (NHS), which helps cover medical costs. In addition, the state pension and other savings make daily life easier when you plan ahead. To find the right options for housing, support, and finances, check out our services.

Planning for retirement in the UK means thinking about how to make your money last. You want to feel safe, comfortable, and free to enjoy your time. In other words, the goal is to choose investments that help you now and later.

So, let’s look at the best retirement investment options in the UK that many people use to grow and protect their savings.

Pensions are one of the most common ways to save for retirement. You add money while working, and later receive regular payments. After that, you can use this money for daily needs or fun.

An annuity is a plan you buy with your savings. In return, it gives you money every month for life. Also, it helps people who want fixed income they can count on.

Buying property is another way to prepare for retirement in the UK. You can live in the home, rent it out, or sell it later for profit.

In addition, many people feel more secure when they own their home.

ISAs help you save money without paying taxes on the interest. For instance, you can open a cash ISA or a stocks and shares ISA.

Bonds are loans you give to the government or companies. They pay you back with interest. Therefore, they are seen as a safe option.

Not every option fits everyone. That’s why it’s important to think about your goals, risk level, and future needs. Also, some people mix different options to feel safer and earn more. Above all, the best retirement investment options in the UK are the ones that match your lifestyle and comfort level.

Getting ready for retirement in the UK takes time, but small steps now can make life easier later. In other words, it’s all about planning smart and early. You don’t need to be rich or know every detail, you just need the right guide.

So, here are simple tips to help you feel more prepared and confident about your retirement plans.

Before retiring, it’s good to look at your money and think about your needs. Use this checklist to keep things simple:

In addition, keep everything written down so it’s easy to check later.

Some people don’t plan early enough or forget to count extra costs. After that, they may feel stressed or unsure about what to do next.

Here are a few mistakes to watch out for:

Therefore, planning now can help you stay on track.

You’re not alone in planning for retirement in the UK. There are helpful tools, websites, and people who can support your journey.

For instance, you can:

Above all, it’s okay to ask for help. Simple steps today lead to a smoother, happier retirement tomorrow.

Retirement in the UK means leaving full-time work and living on your pension, savings, or other income. For instance, it’s a time to slow down and enjoy life. Most people use this time for hobbies, rest, travel, or spending time with family. So, it’s important to plan ahead and feel ready.

The retirement age in the UK is usually 66 years old, but this can change. In addition, your exact age depends on your birth year and future government changes. After that, you may choose to keep working or start using your pension. It’s best to check your personal retirement age online or with an expert.

Yes, but there are rules. You may need a visa or legal residency. So, it’s important to check what’s needed before you move. In other words, not everyone can just move and stay without permission. Talking to a legal expert or reading government guides helps you get the right information.

Living costs depend on where you live and your lifestyle. Cities can be expensive, while small towns may cost less. Also, healthcare is free under the NHS, but private services may cost more. Above all, it’s smart to create a budget for rent, food, travel, and hobbies.

To get ready for retirement in the UK, start saving early and plan your expenses. For example, write down what you earn, spend, and save. In addition, learn about pensions, housing, and local support. It’s okay to ask for help. Many guides and services are made just for retirees.

About International Property Alerts

International Property Alerts is a premier global platform connecting real estate investors with handpicked opportunities in emerging and lifestyle-driven markets. Through curated listings, expert guidance, and market insights, we help buyers make confident property decisions worldwide.

Media Contact:

Phone: +4477 1923 8132

📱 WhatsApp: +63927 073 9530

Email: office@internationalpropertyalerts.com

Elle Resort & Beach Club offers a rare chance to own property in one of the most desirable coastal locations. With limited units, strong capital growth potential, and unmatched resort facilities, this is your opportunity to secure a beachfront lifestyle with long-term value.

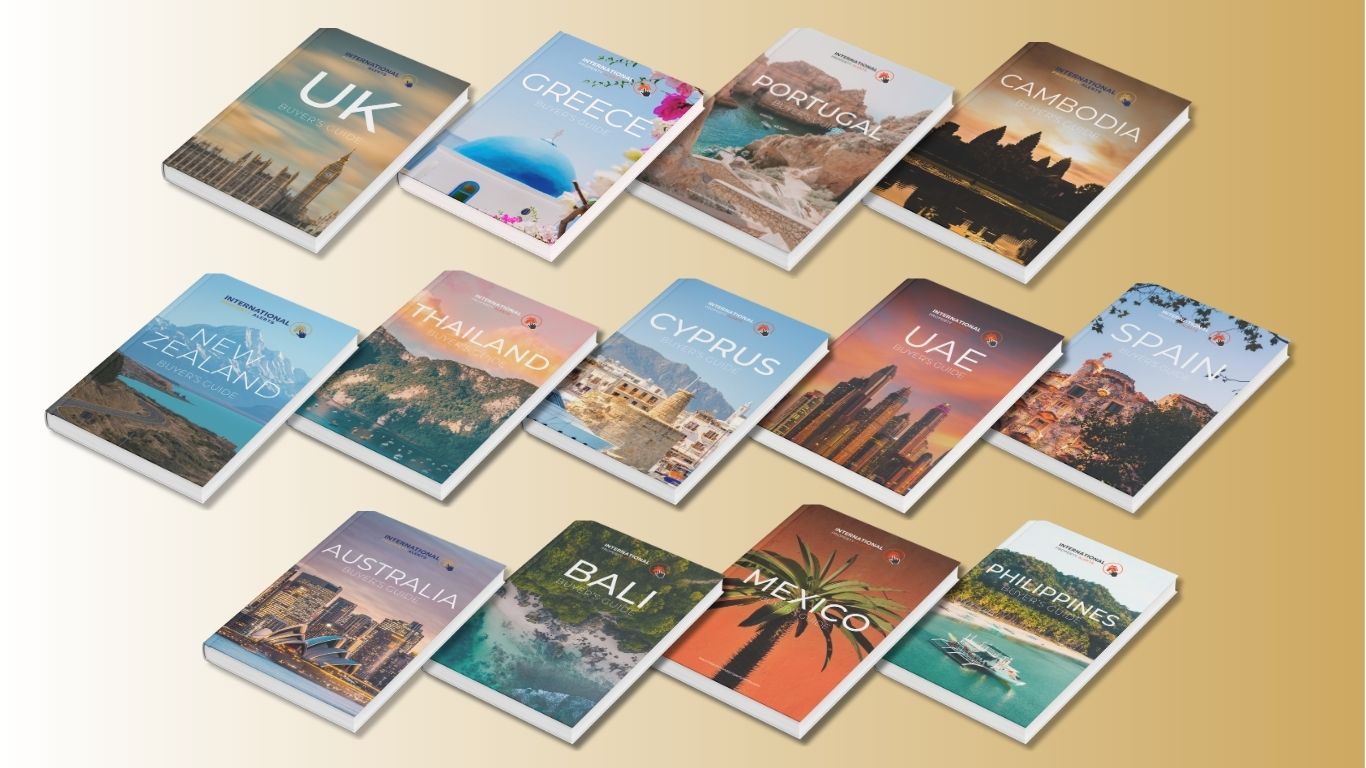

Thinking about buying property abroad? Don’t make the move without the right knowledge. Our Free Buyers Guide gives you essential insights on legal steps, taxes, financing, and the best markets worldwide. Trusted by international buyers and investors.

Wake up to bright, spacious living with stunning views and modern comforts. Whether for family living, retirement, or a stylish retreat, Sudara Residences makes your dream home a reality

Discover curated property listings with IPS—residential, commercial, villas, land—and get expert guidance through every step.

BONUS: FREE Cambodia Buyer’s Guide

High visibility. Targeted audience. Maximum exposure. Rent this space and let your brand shine.

Get your properties in front of high-intent investors. Showcase your listings to buyers worldwide.

From pounds to pesos, yen to dollars. ⚡ Quick. Easy. Secure.

Compare listings

ComparePlease enter your username or email address. You will receive a link to create a new password via email.